According to research from PGIM, only half of financial advisors report using alternative investments in client portfolios. Of the advisors who do, 31% indicate they have access to a wide range of alternative investment options while 19% cite limited access.

Of advisors who do offer alts, most prefer to do so via mutual funds and ETFs. But an entire sector of clients’ net wealth still remains untapped by most financial advisors.

Here’s why collectibles have gone overlooked by most financial advisors, and why to take this investment sector more seriously.

Collectibles: The basics

What are collectibles?

Collectibles refer to items that gain value with time due to rarity, popularity, and condition, among other elements. Examples of collectibles include fine art, jewelry, wine, antiques, handbags, watches, cards, cars and more.

How big is the collectibles market?

The global collectibles market reached a reported $412 billion in 2021, and is predicted to reach $692.4 billion by 2032.

Why do people invest in collectibles?

For many, collectibles serve as an intersection between passion and investment.

On the investment end, collectibles serve as a physical store of value, providing an extra layer of diversification and safety during times of volatility and uncertainty.

On the other end, collectibles often serve as a passion, bringing a level of satisfaction that other investments can’t offer.

Who invests in collectibles?

Investors who have larger portfolios (ultra-high-net-worth investors) and those who are older in age are more likely to own collectibles. Younger investors (20s and 30s) are less likely to already own collectibles.

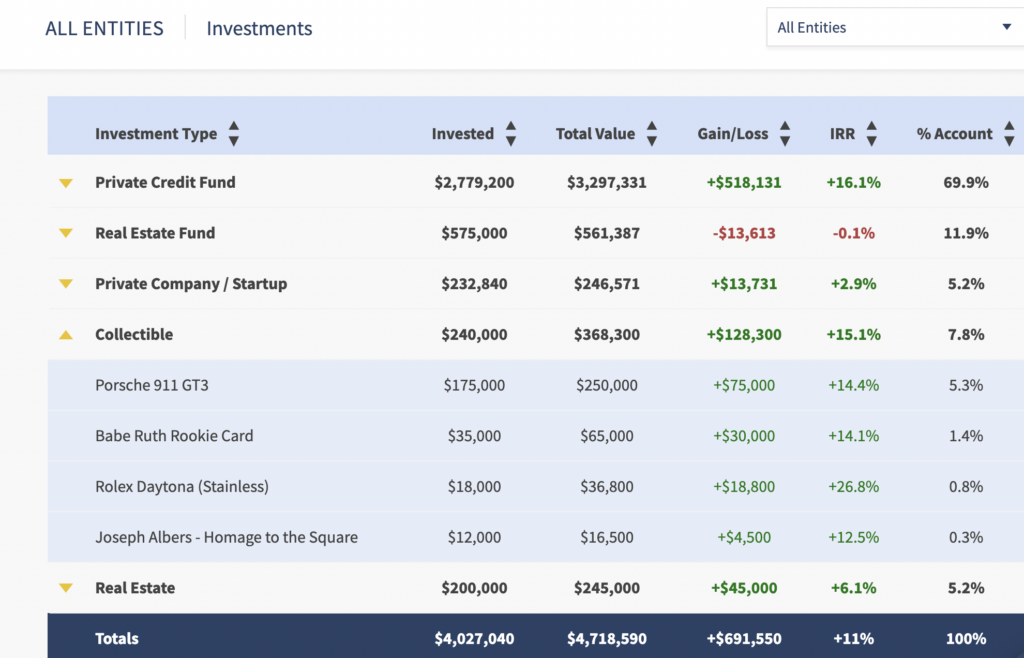

For advisors with ultra-high-net-worth clients (at least $30 million), expect about a 5% (at least $1.5 million) allocation to collectibles.

How financial advisors can track clients’ collectibles

It’s likely that many of your clients – especially those with greater wealth – already own collectibles. Regardless of whether or not you support collectibles as an investment, gaining full insight into your clients’ wealth provides great benefits.

Taking collectibles into consideration allows advisors to have a more holistic view of their clients’ net worth, the ability to provide unique, tailored financial advice, and better meet KYC (Know Your Customer) standards.

Tracking your clients’ collectibles doesn’t have to be complicated either. AltExchange platforms allow advisors and investors to easily track collectibles, both automatically (for investments held digitally) or manually by adding and updating investment data directly on the platform.

Ready to gain a holistic view of your clients’ portfolios and start tracking collectibles? Set up a call or book a demo to learn more.