35% of Americans worked with a financial advisor this year, a slight decrease from the previous year. The number of advisors, however, grew 16.7%, managing more than $128.4 trillion in assets.

With financial advisors rising in number, it’s imperative to set yourself apart to win more clients, and win quality clients. Here are 5 things high-net-worth individuals are looking for in a financial advisor, and how you can embody them.

1. Tailored financial advice

Due to a volatile past few years, clients’ needs are highly varied. Therefore, financial advice should be highly varied as well. Clients are looking for advisors who can empathize with their current situations, and will take action to help them meet future goals.

Rather than providing calculations, reviewing numbers, or plugging stats into standardized financial models, try to reach a more personal level with your clients. One great way to do this is by focusing on real-life goals such as when and where your client hopes to retire, their children’s college education plans, and incorporating other major life events into your plans for each client.

2. A holistic view of net worth

Helping clients truly meet their goals requires taking a holistic approach to portfolio management.

Your clients’ net worth does not only consist of the money allocated to public markets. In order to provide the most tailored experience possible (as we mentioned in #1), advisors need full insight into their clients’ financial standing, including:

- Their primary residence and any other properties they may own.

- Private market investments ranging from private equity and hedge funds, to small amounts of crypto.

- Passed down heirlooms, such as fine art or jewelry.

- Investments in employee-sponsored retirement accounts such as a 401(k).

So how can you accurately and easily track net worth? Most advisors who do so are tracking manually via outdated spreadsheets: A highly time-consuming, unsustainable method.

AltExchange provides financial advisors a way to automate and aggregate all their clients’ alternative assets in one simple solution. To learn more, please schedule a call or book a demo.

3. Maximized returns

During recession is when clients need professional help the most. Right now, it’s important to encourage your clients stay the course, help manage negative emotions, and hold them accountable with their own habits.

But that’s not all advisors can do to help clients during low periods (like right now). Financial advisors can provide maximized returns by taking advantage of alternative investments that are unaffected by public markets. Private equity, for example, has seen some of its strongest return rates during recession years. (For more on private market investments, see #5.)

4. A positive reputation

Unsurprisingly, data shows that the vast majority of people conduct online research before choosing to commit to a professional service.

There are plenty of ways to start building a positive online reputation. The first place to start is by providing the best experience possible for your existing clients, and then asking them to provide a review.

Additional ways include creating insightful content, such as a blog on your website, showcasing your knowledge through posting on LinkedIn, or even creating a monthly newsletter.

5. Alternative investments

The classic 60/40 portfolio garnered an 11.1% annual return rate over the last decade. Yet in current times, it yields less than 2%.

To maximize your clients’ returns, advisors must be diversifying into other asset classes (alternative investments). In fact, private equity has consistently outperformed the S&P 500 for more than a decade now. Other alternatives, such as real estate, hedge funds, startup investments, commodities, crypto, and more, are all attracting high-net-worth investors.

By offering private investments, you’ll not only help current clients maximize returns, but will also attract higher-net-worth clients.

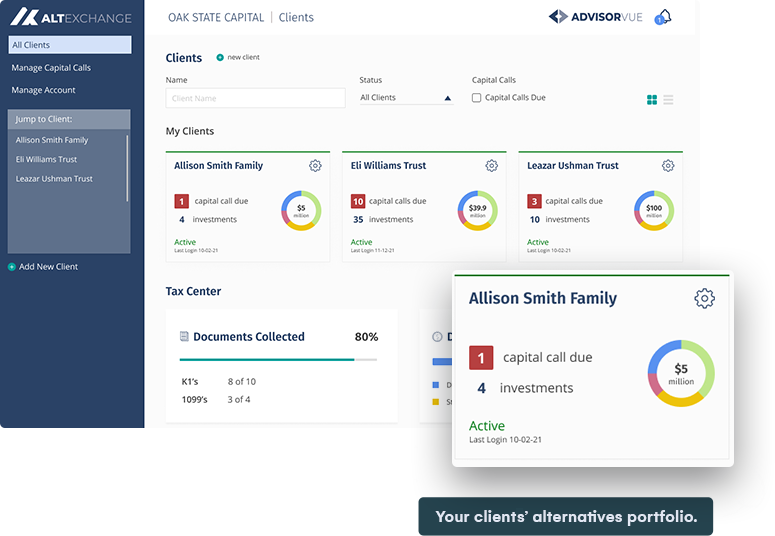

Whether you’re an advisor currently offering alts looking to streamline your workflow, or an advisor hoping to offer alts, AltExchange’s advisor solutions can help. AdvisorVue is the fully-automated advisor solution to manage, track, and report all clients’ alternative investments, on one platform.

To get started or learn more information, please schedule a call or book a demo.