Catering to Ultra-High Net Worth (UHNW) clients requires more than traditional investment management; it demands a deep understanding of their unique position, needs, and expectations. These clients are not merely seeking wealth management services; they are searching for a holistic approach that aligns with their distinct financial goals and aspirations.

Here, we delve into the key insights that financial advisors should keep in mind when navigating the world of UHNW clients, and how to win and keep them.

1. Alternative Investments: The 50% Rule

For UHNW investors, alternative investments often make up a substantial portion of their portfolios, averaging around 50%. This significant allocation underscores the importance of advisors’ familiarity with alternative assets.

To thrive in this space, it’s imperative for advisors to integrate alternative investments into their offerings. Whether it’s hedge funds, private equity, or real estate, being well-versed in these options can be a game-changer in attracting and retaining UHNW clients.

2. The Power of Personalization

Gone are the days of generic financial advice. UHNW individuals seek advisors who understand that one size does not fit all. They yearn for customized wealth management strategies that reflect their unique financial objectives, risk tolerance, and family dynamics.

Today’s UHNW clients are looking for tailored solutions that speak directly to their aspirations. Advisors who can provide this level of personalization stand out in the crowd.

3. Access to Exclusive Opportunities

UHNW clients are not content with ordinary investment opportunities. They have high expectations for exclusive access to strategies and opportunities that are off-limits to the general public.

Advisors must leverage their connections and expertise to unlock these exclusive doors. Demonstrating the ability to provide unique investment opportunities showcases dedication to meeting UHNW clients’ expectations.

4. Trust and Transparency: The Foundation of Success

Trust is the cornerstone of any successful relationship with UHNW clients. These individuals demand transparency in all financial dealings.

Advisors should be forthright about their wealth management practices, fees, and potential conflicts of interest. Regularly reporting on the performance of investments is crucial to ensure that clients’ best interests are at the forefront.

Trust is not just earned; it’s nurtured through open, honest, and transparent communication.

5. Exceptional Service: The Ultimate Differentiator

UHNW clients have high standards for service. They expect their advisors to be readily available to address their concerns and provide updates on their portfolios. Proactive communication and a commitment to providing an exceptional client experience are non-negotiable.

Advisors who go above and beyond in delivering impeccable service create lasting relationships that endure through market fluctuations and economic shifts.

In the realm of UHNW client relationships, it’s not merely about managing wealth; it’s about creating partnerships grounded in trust, transparency, and exceptional service. Financial advisors who can master these elements are well-positioned to excel in serving this elite clientele.

The Bottom Line

UHNW clients represent a unique and demanding segment of the market. Success in this field requires a commitment to understanding their specific needs and delivering a level of service that exceeds expectations.

By incorporating alternative investments, embracing personalization, providing access to exclusive opportunities, prioritizing trust and transparency, and delivering exceptional service, financial advisors can build enduring relationships that stand the test of time.

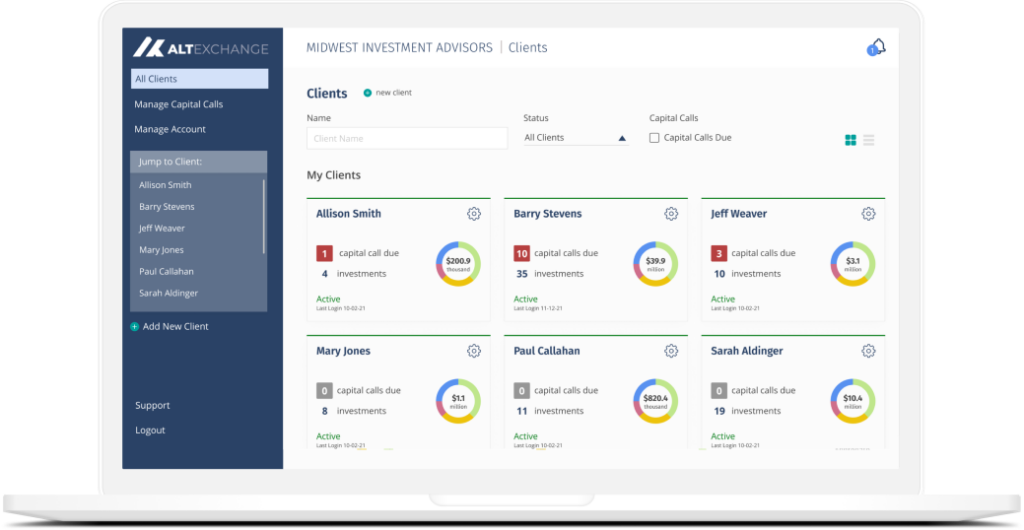

To learn more about how AltExchange can help you better serve UHNW clients through alternative investment management, please book a call or respond directly.