Commercial real estate can be a lucrative investment, but it’s not always easy to find the right opportunities. This guide will teach you how to find commercial real estate investments that fit you or your clients’ needs and budget.

Here is a variety of strategies for finding commercial real estate investment deals, tips for evaluating potential properties, and finally how to manage your investments.

The basics of commercial real estate investing

Commercial real estate investing can be a lucrative way to grow your portfolio, but it’s important to understand the basics before you get started. Here are some of the most important things to know:

1. Commercial real estate is a type of property that is used for business purposes.

2. Commercial real estate investments can be quite lucrative, but they come with more risk than residential investments.

3. Commercial real estate investments usually require a larger down payment and longer closing times.

4. Commercial real estate leases are typically longer than residential leases, and they often have more restrictive terms.

5. Commercial real estate properties are usually assessed at a higher value than residential properties.

Who should invest in commercial real estate?

Commercial real estate can be a great investment for anyone looking to grow their portfolio, but it’s not right for everyone. There are a few important things to consider when deciding if you or your clients are a fit for commercial real estate investing.

Since commercial real estate investments come with more risk than residential investments, so you need to be comfortable with that risk.

Second, it’s important to consider the cost associated with investing in commercial real estate. Commercial real estate deals usually require a larger down payment and longer closing times than residential deals. Compared to residential properties, these real estate properties are usually assessed at a higher value, so investors need to be prepared.

Finally, flexibility and commitment an important factor to consider. Commercial real estate leases are typically longer than residential leases, and often have more restrictive terms.

How to find commercial real estate investments

1. Know what you’re looking for.

When looking for a commercial real estate investment, it’s important to know what you’re looking for. Here are a few things to consider:

- Location. The location of the property is key, and you’ll want to make sure it’s in a desirable area. You’ll also want to make sure that the property is in a good physical location, with easy access and plenty of parking.

- Size. The size of the property is important, and you’ll want to make sure it’s big enough to meet your needs. You’ll also want to make sure that the property is in good condition and has ample space for your business.

- Price. The price of the property is obviously important, and you’ll want to make sure you’re getting a good deal. You should also be aware of any ongoing expenses, such as maintenance or property taxes.

- Lease terms. The lease terms are another important consideration, and you’ll want to make sure they’re favorable for your business. You’ll also want to make sure the lease allows for future growth potential.

2. Research commercial real estate brokers.

When looking for a commercial real estate broker, it’s important to find someone who is knowledgeable and experienced in the market. Here are a few things to look for:

- Experience. Look for a broker who has experience in the commercial real estate market. This will ensure that they have the knowledge and expertise to help you find the right property.

- Knowledge. Make sure the broker has a good understanding of the commercial real estate market. This will help them find the best deals for you.

- Networking. The broker should have a large network of contacts in the commercial real estate market. This will help them find the best properties for you.

- References. Ask for references from past clients to see how the broker performed on past deals.

3. Research commercial real estate listings.

There are a variety of ways to find commercial real estate listings, and it’s important to research all your options before making a decision. Here are a few ways to find listings:

- Online listings services: There are a number of online listing services that offer a wide variety of commercial properties for sale or lease. This is a great way to get started if you’re not sure where to start looking.

- Commercial real estate newspapers and magazines: There are a number of commercial real estate newspapers and magazines that offer listings for commercial properties nationwide. This is a great way to get an overview of all the commercial properties available in your area of interest.

- Commercial real estate brokers: Most commercial brokers have access to property listings that aren’t listed online or in newspapers and magazines. This is a great way to find exclusive deals that aren’t available anywhere else.

4. MLS (Multiple Listing Service).

The MLS is a database of all commercial properties listed for sale or lease in the United States and Canada. This is an excellent resource for finding commercial properties in your area of interest.

How to manage your commercial real estate investments

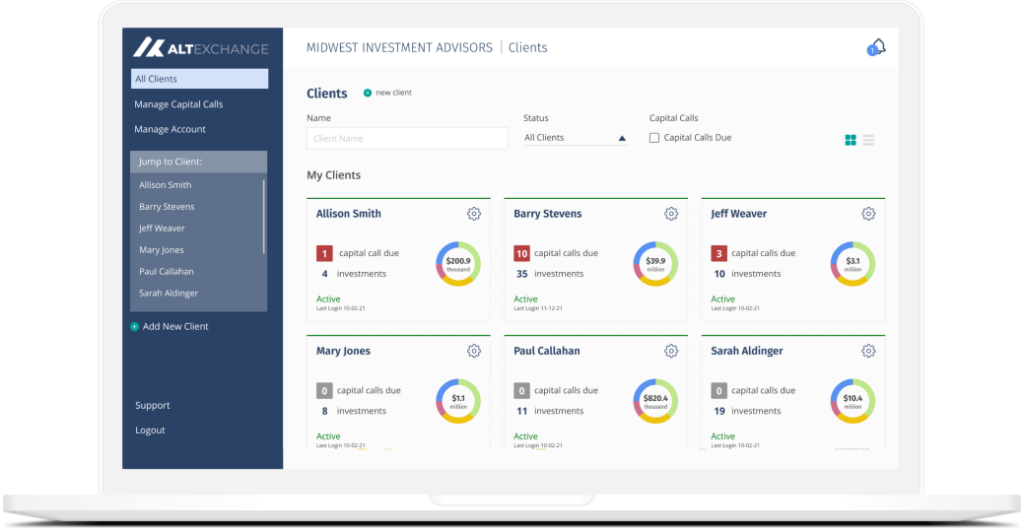

If you or your clients are investors of commercial real estate, including direct-owned, you do have an alternative to managing your investment via a spreadsheet.

AltExchange eliminates common pain points of managing complex alternative investments including fragmentation, unstructured data, scattered documents, limited performance visibility, and more. If you’re an advisor, investor, or asset manager looking for a full-service management and reporting solution for alternative investments, please get in touch.