The use of automation in tax management offers a plethora of benefits for financial advisors. Here’s how advisors can use automation to streamline their clients’ taxes, and how AltExchange, a cutting-edge technology platform that automates alternative investments, can be a valuable tool in achieving this.

Save Time

Time is a valuable resource for financial advisors, and automation can significantly reduce the time spent on manual tax-related tasks. Not to mention, the more time you have available to spend on building client relationships, the better.

By automating tasks such as collecting tax documents, you’ll have more time to spend on nurturing your client relationships and also winning new business. With platforms like AltExchange, financial advisors no longer need to spend hours collecting and organizing tax documents, tracking deadlines, or following up with clients. The platform’s automated syncing and notification system streamlines the process, freeing up time for financial advisors to focus on more strategic and value-added activities, such as providing personalized advice to their clients, building relationships, and growing their business.

Increased accuracy

Tax-related errors can be costly and time-consuming to rectify. However, with automation, financial advisors can minimize the risk of errors.

Manual data entry can be prone to mistakes, but with AltExchange’s automated system, the data is captured directly from the tax documents, reducing the chances of transcription errors. This increased accuracy ensures that financial advisors can provide reliable and precise tax information to their clients, minimizing the risk of compliance issues and potential penalties.

Enhanced client experience

Providing a seamless and efficient tax process can greatly enhance the client experience. Clients appreciate when their financial advisors use technology to simplify their tax management, making it more convenient and hassle-free.

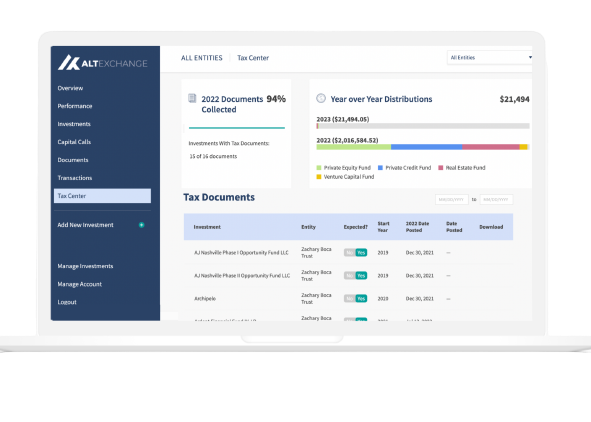

With AltExchange, clients receive instant notifications when new tax documents are available, allowing them to stay updated and organized. The platform also provides year-over-year distribution tracking and yearly percentage of tax documents collected, giving clients a clear overview of their tax situation.

Moreover, AltExchange allows clients to invite their CPA, further streamlining the process and ensuring that all parties are on the same page. This enhanced client experience can lead to increased client satisfaction, loyalty, and referrals.

Scalability

Automation can greatly improve the scalability of a financial advisory business. Manual tax management processes can become cumbersome and time-consuming as the number of clients increases.

However, with automation, financial advisors can handle a larger volume of tax-related tasks with ease. AltExchange’s automated syncing and notification system can handle a large number of tax documents, making it much easier to scale your business by increasing your volume of service, without any extra time involved.

If you’re an advisor looking to unlock the benefits of automation when it comes to managing your clients’ tax documents, keep your current clients happy, and open up opportunities to win new clients in a rapidly changing industry, please book a demo or reach out at hello@altexchange.com.