For those who requested a tax extension this year, the deadline to file is October 17, 2022. Until then, financial advisors, CPAs, and investors will scramble to get all necessary documents in order, only to repeat the same process next year. But it doesn’t have to be that way.

Here’s how financial advisors and accountants can save countless hours on their clients’ taxes for years to come.

Do: Know all your clients’ investments

It’s imperative to know your clients’ entire investment portfolio to ensure all necessary paperwork is filed. For those dealing with rather complex portfolios, it’s easy to let something slip through the cracks. But this could come at a great cost.

If you fail to report taxes on all necessary investments, your client may be liable for a 0.5% penalty (plus daily compound interest) of the overdue amount every month the payment is late. In extreme cases, the IRS may investigate for tax fraud or tax evasion.

The best way to ensure you’ve accounted for all tax documents needed?

Know all your clients’ investments. Keeping all your clients’ investment details – including alternatives such as real estate, crypto, and private funds – in one place saves all parties (advisors, CPAs, and investors) precious time, money, and peace of mind.

Gaining a comprehensive overview of your clients’ portfolios doesn’t require much effort, either. AltExchange solutions aggregate all your clients’ alternatives in one streamlined platform, eliminating the need for manual spreadsheets and added workload.

Do: Know which documents you need for each investment

Now that you have a clear picture of your clients’ portfolio, it’s time to determine which tax documents are required for each investment type.

Here’s a breakdown of the tax documents required for various alternative investments:

- 1040, Schedule C, Schedule SE: Required for business owners and self-employed.

- 1098 (Mortgage Interest Statement): Report mortgage interest of $600 or more.

- 1099-B, 1099-S: Required for income from stock or property sales.

- 1099-DIV, 1099-INT, 1099-OID: Required for investment income made through interest or dividends.

- 1099-MISC: Required for “side hustle” income (e.g. selling art or collectibles), royalty (copyright/patent) income, and other compensation generating more than $600 per year.

- Schedule K-1 (Schedule K): Required for private fund investments (e.g. private equity, hedge funds, private credit).

- Schedule K-2, Schedule K-3 (New as of Feb. 16, 2022): An extension of Schedule K-1, required for tax years beginning in 2021. Find more details on the IRS website.

Additional documentation may be required. For example, real estate investors should be prepared to provide property tax records, rental income records, and rental property expense records.

Do: Spend less time chasing documents

Collecting tax documents often entails a long, arduous game of telephone among clients, accountants, financial advisors, and other parties distributing tax forms. But as we mentioned earlier, it doesn’t have to be that way.

Spending less time chasing tax documents sounds easier said than done; But with the right tools, it actually is that easy.

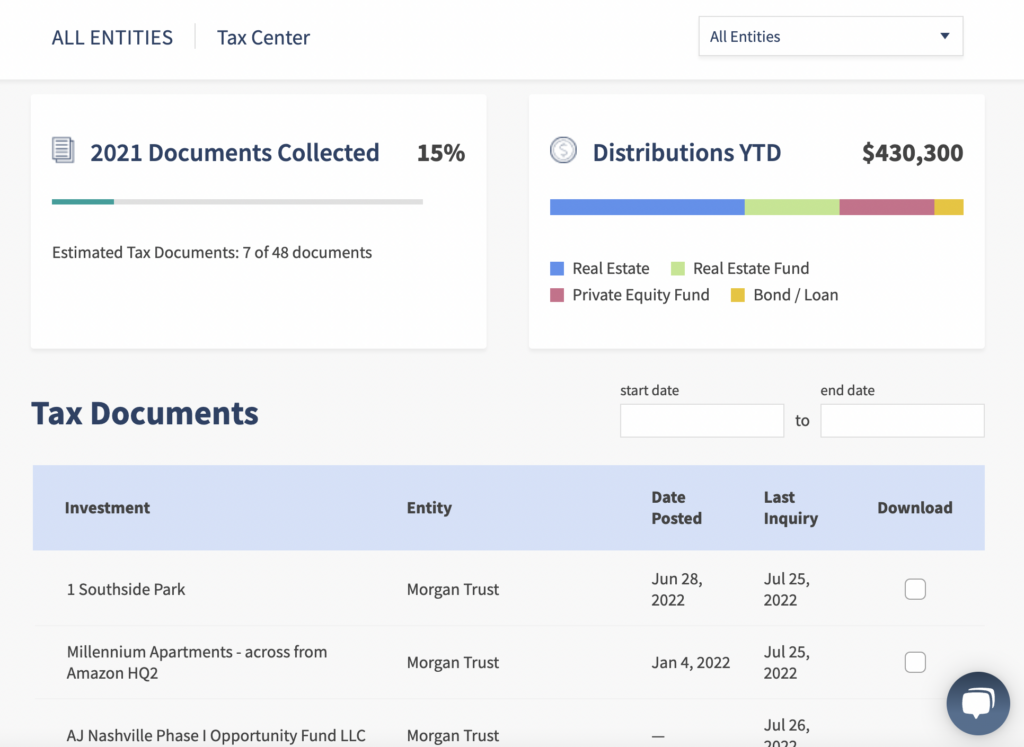

AltExchange’s Tax Center:

- Automatically collects and tracks progress on Investment Tax Documents.

- Downloads and organizes your clients’ Tax Documents (e.g. K-1s, 1099s).

- Ability to request / submit Tax Documents for Investments that do not have an online presence.

- Maintain Asset Manager and Tax Accountant contact details.

- Track prior year investment distributions by type (e.g. Private Equity, Real Estate, Venture, Startup, Crypto).

When tax season rolls around, your clients’ tax documents will have already been collected for you.

Ready to stop chasing documents and start streamlining your next tax season? Let’s talk.