In today’s rapidly evolving financial landscape, data has become the lifeblood of successful decision-making for Registered Investment Advisors (RIAs).

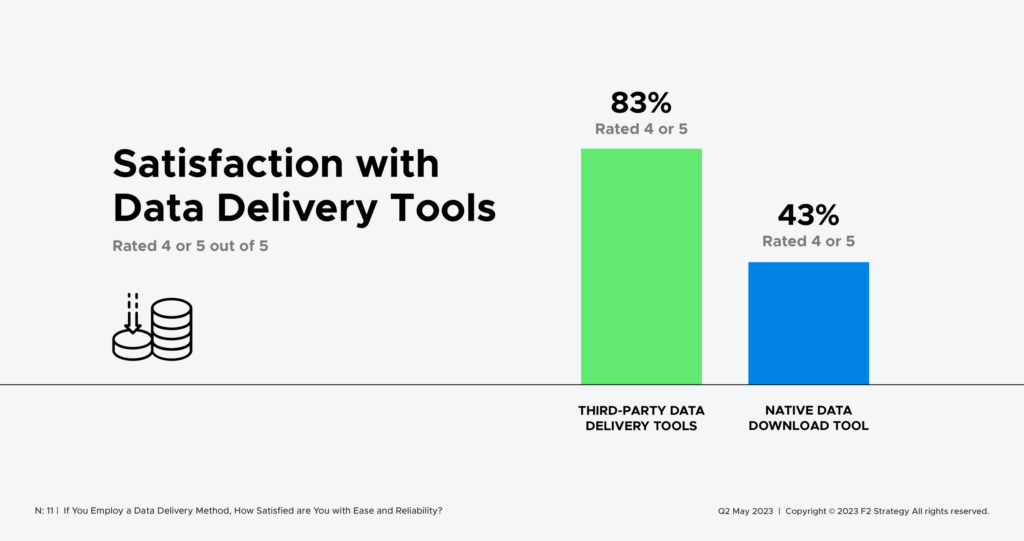

However, recent research indicates that less than half of financial advisors report satisfaction with their existing data delivery tools. In fact, only 43% of RIAs are satisfied with their data delivery tools. (Source: F2 Strategy)

The growing demand for modern and efficient data solutions highlights the need for innovation in this crucial aspect of the advisory process. Let’s delve into the challenges faced by RIAs, the importance of embracing external data tools, and how AltExchange is transforming the alternative investment data management landscape.

The Quest for Modern Data Delivery

The financial advisory industry has witnessed a paradigm shift in recent years, driven by advancements in technology and the increasing complexity of investment strategies. Traditional methods of data delivery, often reliant on manual processes and outdated systems, are proving insufficient to meet the demands of today’s RIAs.

As mentioned above, according to a recent study from F2 Strategy, only a mere fraction of advisors express contentment with their current data delivery tools. This dissatisfaction arises from a variety of pain points, such as fragmented data sources, lack of real-time insights, and difficulties in integrating alternative investment data with traditional investment information.

Beyond Outdated Tools: Embracing External Solutions

As the financial advisory landscape evolves, it’s clear that the challenges posed by data delivery require solutions beyond the scope of in-house tools.

Recognizing this need for innovation, forward-thinking RIAs are turning to external platforms that specialize in data management and integration. These platforms offer the advantage of expertise and dedicated resources, ensuring that advisors have access to the latest technology and methodologies.

AltExchange: Revolutionizing Alternative Investment Data Management

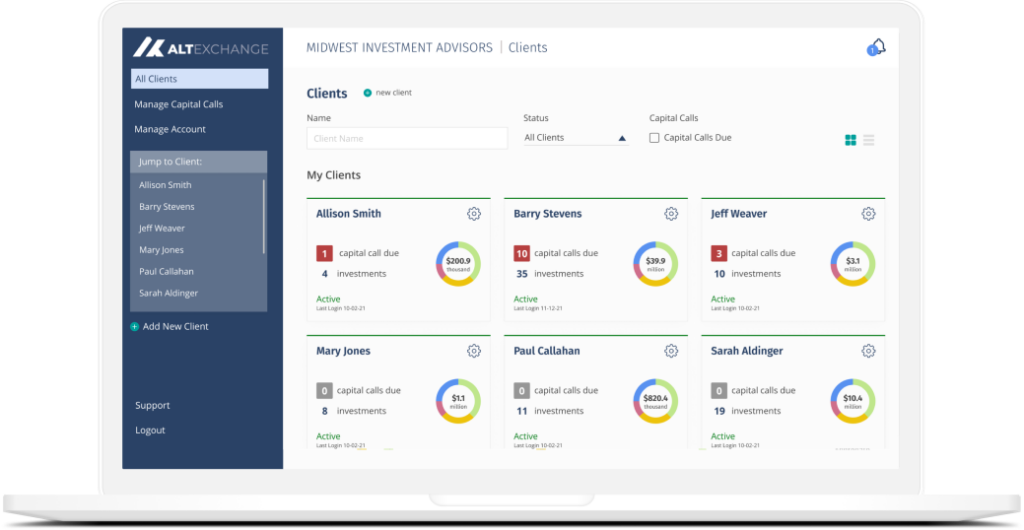

As an alternative investment management platform made for financial advisors, AltExchange is designed to seamlessly integrate alternative investment data with traditional investment data. This integration provides RIAs with a comprehensive view of their clients’ wealth, enabling them to make informed decisions with clarity and confidence.

AltExchange’s approach is rooted in efficiency and accessibility. By streamlining the process of gathering, aggregating, and presenting data, AltExchange empowers advisors to focus on their core competencies while leaving the complexities of data management to the experts. With real-time updates and intuitive visualizations, AltExchange ensures that RIAs have the tools they need to stay ahead in an increasingly dynamic market.

The Bottom Line

Overall, outdated tools are no longer sufficient to meet the demands of a modern financial advisory practice. Embracing external solutions is not just a trend but a necessity to ensure efficiency and accuracy in data management.

If you find yourself among the many advisors seeking a comprehensive and streamlined solution for managing alternative investment data, AltExchange is here to revolutionize your approach. Say goodbye to fragmented systems and hello to a new era of integrated, accessible, and insightful data management.

To learn more about how AltExchange is transforming the landscape of alternative investment data management, please get in touch.