As the stock market continues to be volatile and unpredictable, financial advisors are increasingly looking for alternative investments that can provide their clients with greater portfolio diversification. In 2023, alternative investments offer a great opportunity to help protect against economic uncertainty while still providing attractive returns. With the right strategy in place, advisors can take advantage of these unique opportunities and reduce risk while also increasing potential returns for their clients. Financial advisors should consider allocating some portion of their client portfolios to alternative investments as part of an overall asset allocation strategy in order to maximize return potential and minimize risk exposure in this ever-changing environment.

Here are five alternative investment opportunities to consider for your clients in 2023.

Private equity

Private equity investments are a great option for financial advisors looking to diversify their clients’ portfolios while still providing attractive returns. Private equity funds invest in companies that are not publicly traded, allowing investors to access unique opportunities and businesses with high growth potential. These investments can provide higher returns than traditional stocks and bonds, as well as greater control over the asset allocation of the portfolio. Additionally, private equity investments have less volatility than other alternatives, helping reduce overall risk exposure for investors. Therefore, financial advisors should consider allocating some portion of their client portfolios to private equity investments in order to maximize return potential and minimize risk exposure in an ever-changing environment.

Managing private equity investments manually can be complex, however. AltExchange provides advisors a way to seamlessly manage private equity investments alongside all other alternatives. Click here to see how.

Real estate

When it comes to real estate, there’s a good chance your clients are already invested in it. In fact, nearly 40% of the average millionaire’s net worth is in real estate. Yet most advisors aren’t considering their clients’ real estate investments in their managed portfolio. AltExchange makes it easy for advisors to aggregate their clients’ existing and future real estate investments alongside their other alternatives.

Private lending

Private lending is an attractive investment option, as it is typically more flexible than lending opportunities from lenders such as banks. Private lending investments can come with high returns, and are not correlated to the public markets, as we’ve seen with other illiquid alternative investment opportunities on this list.

As a financial advisor, it’s up to you to decide if private lending investments make sense for your clients. If you’re interested in offering private lending investments but not sure how to get started managing them, our automated solution can help.

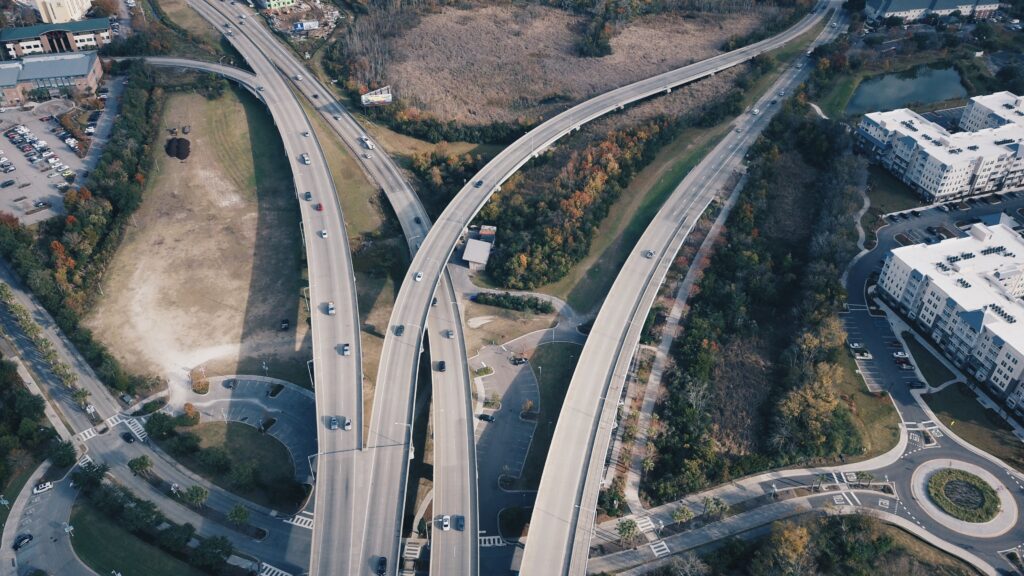

Infrastructure

Infrastructure investments are one of the most-eyed investments right now by institutional investors. Infrastructure investments include real assets such as bridges, roads, highways, and other city structures. To invest in infrastructure, advisors can check out infrastructure funds or even infrastructure ETFs.

Commodities

Commodities as investments include raw materials such as oil and natural gas, agricultural products such as wheat and corn, and previous metals such as gold and silver, among other things. Commodities, as they are physical assets, can help minimize portfolio volatility as their correlation to the stock market is low and they are considered a hedge against inflation.

AltExchange offers solutions to help advisors manage, track, and report all alternative investments. If you’re an advisor currently offering alternatives, or just interested in getting started, check out how our technology-powered solution works for you.

Interested in more information? Schedule a call or book a demo today.