The demand for real estate investment management is growing, with an estimated 30 million Americans holding both commercial and residential real estate. Unfortunately though, most financial advisors are unwilling to incorporate real estate into their services whatsoever. But the few advisors who are willing to offer real estate can expect to win big.

Here’s how financial advisors can start tracking their clients’ existing and future real estate investments.

Why most advisors avoid real estate

There are two main reasons advisors typically avoid incorporating real estate investments into their practice:

- Compensation models don’t account for real estate investments.

Most financial advisors traditionally follow either a commission-based structure or a fee-based structure. In either scenario, advisors are only paid based on the assets under their own management (e.g. stocks, bonds, etc.). Encouraging clients to invest in assets outside of those they are actively managing can pose a conflict of interest.

- Lack of education/expertise surrounding real estate.

Real estate investing is not part of traditional financial education models, and requires extensive external education and more preferably, personal experience. Not to mention, there are regulations restricting what advisors can and cannot give guidance on – unlicensed products (including real estate) may be restricted for advisors who do not meet the requirements.

The bottom line is: Traditionally, real estate has been off limits for most financial advisors. But there are actually ways to incorporate it into your offerings as an advisor, without compromising on either of the reasons listed above.

But first, let’s go over why it’s important for advisors to add real estate tracking to their practice.

Why real estate is imperative to your financial planning practice

There are plenty of reasons high-net-worth individuals choose to invest in real estate, including: tax benefits, portfolio diversification, equity-building, leverage, and to hedge against inflation, to name a few. And real estate investing doesn’t seem to be slowing down anytime soon:

- Real estate accounts for 22% of high-net-worth investor portfolios.

- 70% of the nearly 20 million rental properties in the US are owned by individual investors.

- 41% of Institutional Investors plan to increase allocation to real estate by 2025.

Whether or not you as an advisor recommend investing in real estate, it’s likely that most of your clients are already investing in it – especially high-net-worth individuals. As interest in real estate continues to grow, advisors must adopt new strategies to meet demand.

How advisors can better serve clients with real estate investments

The financial services industry, for the most part, has not yet modernized to meet the changing demands of modern-day investors. But this means for financial advisors who are willing to adopt new strategies to keep up with the shift to alternatives, like real estate, there is great opportunity.

As we’ve covered, most high-net-worth individuals are already investing in real estate. And you don’t need to be a real estate expert to better serve your clients who own real estate.

In fact, one of the best ways advisors can provide value to their clients is by providing a holistic view of net worth. And with real estate making up an average of 22% of high-net-worth investor portfolios, it’s a key factor in providing an accurate depiction of net worth.

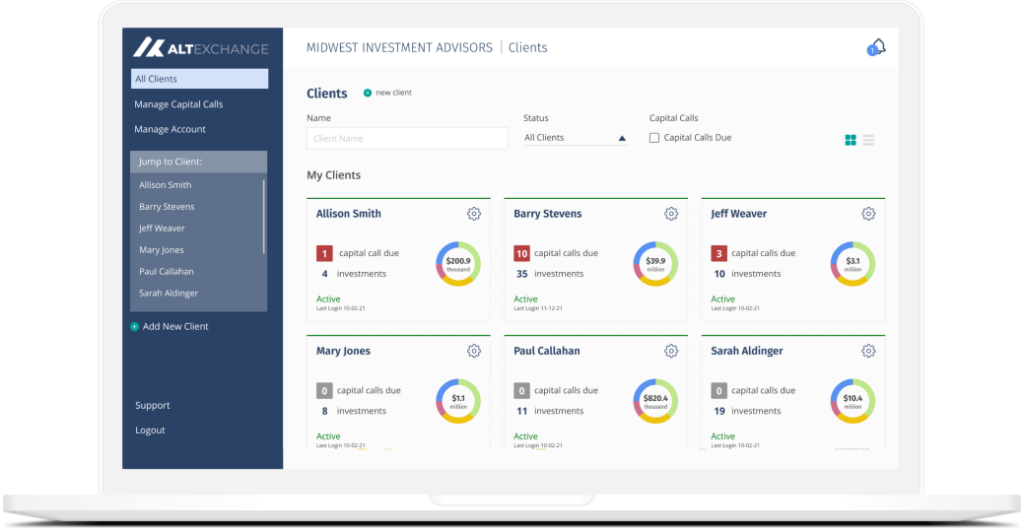

So how can advisors accurately track real estate investments, alongside any other alternative investments? AltExchange platforms allow advisors and their clients a way to:

- Track investments in single and multi-family homes, apartments, office buildings, hotels/motels, student housing, healthcare facilities, storage and warehouses, land, and more.

- Adjust unrealized value to reflect current market conditions.

- Track distributions (e.g. Rent, AirBnB income).

- Synthetic transaction monitoring to account for utilities, property taxes, insurance, and more – coming soon.

To become a winning advisor and start tracking your clients’ real estate investments, please schedule a call or book a demo.