Succeeding as a financial advisor requires the ability to adapt to changing economic environments and ultimately, to the changing needs of your clients.

Clients are increasingly demanding access to more alternative investments. Being able to have a full understanding of your clients’ investments, whether it be real estate, cryptocurrencies, or private equity, is crucial.

Challenges advisors are facing with alternative investments

Back-office challenges: Advisors are experiencing trouble meeting capital calls, collecting important tax documents, and have limited performance knowledge of clients’ alts, to name a few.

Reporting challenges due to unstructured data: Private markets do not follow reporting standards, despite efforts by the Institutional Limited Partners Association (ILPA) and others. Lacking adequate tools, most data lives in PDF statements, with reporting requiring complex, manual data-entry.

Demand for a tech-enabled experience: We live in a tech-enabled world. Only 37% of industries remaining have not been digitized.

Clients are demanding their advisors have a wealth management platform for alternative investments. But not just one with basic, out-of-date reporting, ultimately of little value add.

AdvisorVue: the alternative investment management platform for financial advisors

Understanding the difficulties investors and advisors are experiencing in the alternative investment space, we’ve created a solution of our own.

We’re proud to announce our upcoming release of AdvisorVue, the alternative investment management platform for financial advisors.

What is AdvisorVue?

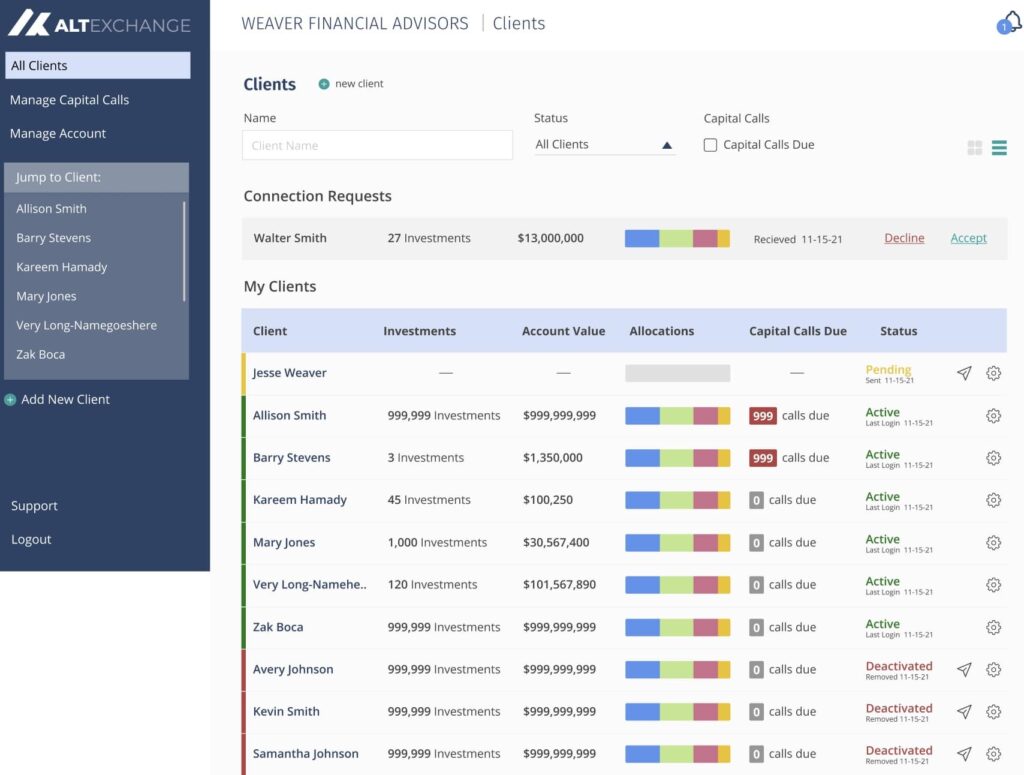

AdvisorVue is a first-of-its-kind alternative investment management platform made for financial advisors. It’s designed to simplify managing your clients’ alternative investments, better understand your clients’ allocation to alts, and allow you to differentiate and level-up your advisory business.

How does AdvisorVue work?

AdvisorVue provides real-time investment tracking and performance reporting, sends capital call reminders and notifications, collects all client tax documents in one place, and more. With AdvisorVue, advisors can export data directly to existing wealth management systems.

Invite your clients to your co-branded portal, where they’ll have access to real-time reporting on their private market investments, centralized documents, and much more.

Gain early access

The ability to differentiate your practice and win clients depends on the ability to keep up with the changing environment — including the increased demand for alternatives.

Be the first 100 advisors to gain early access to AdvisorVue, launching in Spring 2022.