When it comes to your clients’ investment portfolio, knowledge is power. The more you know about what your clients are invested in, the better you’ll be able to help your clients make the best financial decisions for their future. But do most financial advisors really know what their clients own?

Here’s why advisors should know their clients’ full portfolio including existing alternative investments, and how to do it.

1. Gain trust and a positive reputation

Trust is the key to establishing a long-lasting relationship with your clients.

According to a study by Vanguard, 94% of investors were likely to make a referral when they “highly trusted” a financial advisor.

One tangible way to establish client trust is by being proactive in times of stock market volatility and always acting in clients’ best interests. This may mean providing services outside the realm of traditional investments in order to provide the best possible outcomes for your clients

2. Provide a tailored experience

Each clients’ needs are different. Clients are looking for advisors who can really understand their financial situation to help them make the best decisions to meet their future goals.

The best way to provide tailored financial advice is to fully know your clients’ investments – down to the real estate they own, startups they may be invested in, and more.

3. Maximize returns, even in recession

Especially in today’s volatile environment, clients are looking to advisors to help them achieve maximized returns. Advisors need to fully understand each clients’ financial situation and provide tailored recommendations for the best results.

To provide maximized returns, advisors must consider alternative investments. Not to mention, most clients are likely invested in some form of alternatives – even real estate – without your full understanding of the investment.

Whether you decide to offer alternatives or simply gain a better understanding of the alternatives your clients are already invested in, you will gain an edge over advisors who are not doing so.

How to easily track your clients’ full investment portfolio

Is there a simple way for advisors to begin tracking their clients’ alternative investments? Absolutely.

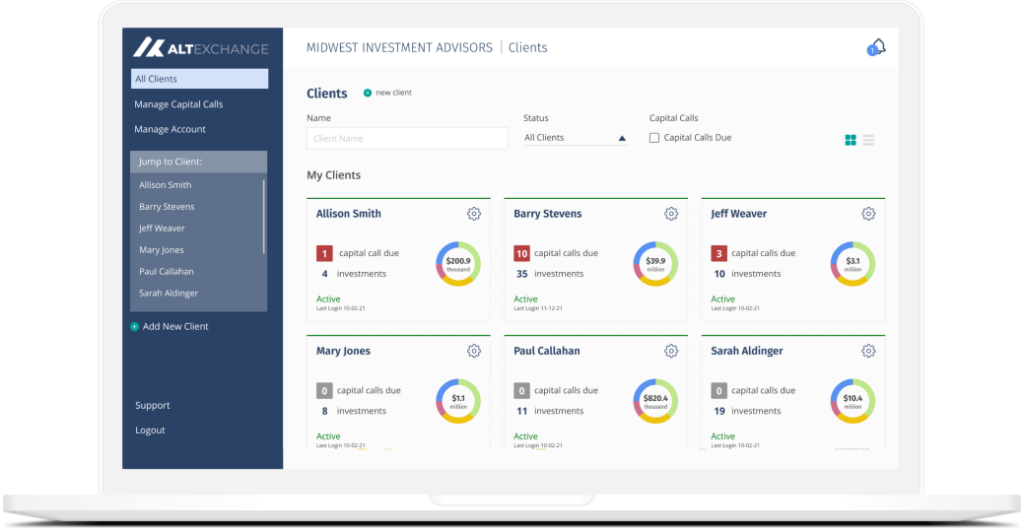

At AltExchange, we believe advisors and investors deserve to track alternative investments like they do their stocks, without the hassle of messy spreadsheets and manual tracking.

AltExchange’s technology-powered AdvisorVue platform provides financial advisors:

- Real-time reporting and consolidation of all clients’ alternative investments.

- Historical reporting on existing investments.

- Automatic collection of tax documents (K1s, 1099s).

- Fully-managed capital calls (automated reminders & notifications).

- Integrations with existing wealth management systems (e.g. Addepar, Black Diamond), allowing advisors to bill for individual investments or account-wide.

For each individual investment tracked, advisors can see the following:

- MOIC

- IRR

- DPI (Distributed/Invested)

- Current value, and more.

If you’re an advisor looking to gain an edge in your business, please book a call or schedule a demo.