44% of institutional investors want to increase their allocations to alternative investments, compared to just 24% who plan to increase their exposure to equities, according to new research from Cerulli Associates. Investors are interested in alternatives to help combat inflationary pressure, as well as boost returns during this difficult environment. Here are the investment types institutional investors are keeping their eye on right now.

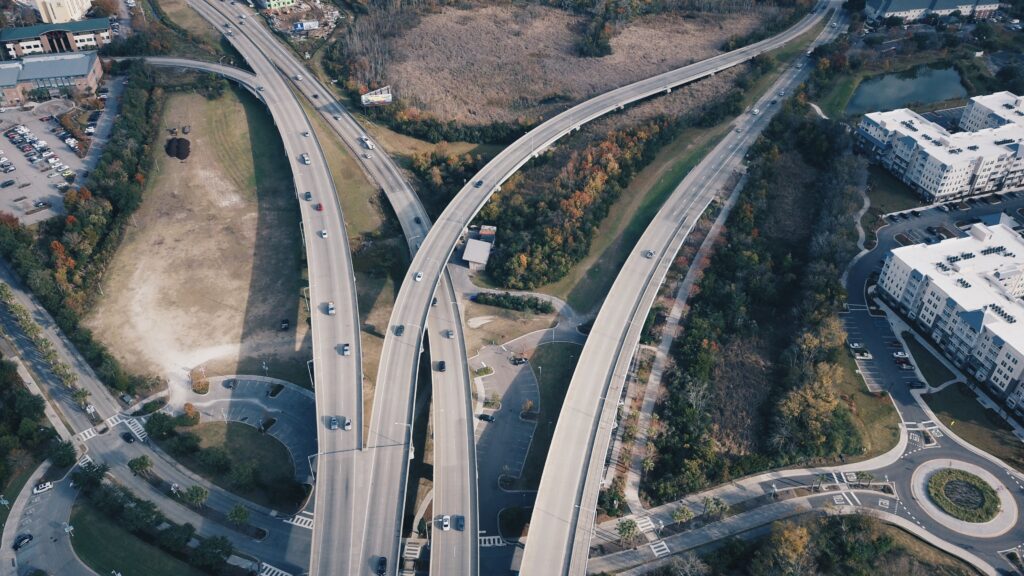

Infrastructure

Infrastructure investments are long-term institutional investments in physical and social assets such as roads, bridges, electricity networks and airports. Such investments offer institutional investors a means of diversifying their portfolios away from traditional asset classes and gaining exposure to the real economy.

Infrastructure investments offer institutional investors attractive potential returns and can serve as a hedge against inflation. These investments also diversify portfolios away from traditional asset classes and provide a source of predictable long-term income.

Real estate

Real estate investments can provide institutional investors with a diversified portfolio, strong cash flow and potential long-term capital appreciation. Real estate investments are typically divided into two categories: direct real estate and indirect real estate.

Direct real estate investments involve the purchase of physical property, such as residential or commercial buildings, land and other tangible assets.

Private equity

Private equity is an alternative asset class for institutional investors looking to diversify their portfolios and access higher returns. It involves the investment of institutional funds in privately-held companies, often with the aim of increasing their value and eventually selling them off to make a profit.

Private equity is a consistently popular investment type among high-net-worth individuals, as it can offer the potential for high returns, and has consistently outperformed public markets over the last decade.

Private debt

Private debt is an alternative investment type that institutional investors use to access higher returns. It involves the institutional investor lending funds directly to companies or other institutional investors, usually with the aim of providing them with access to capital and liquidity. Private debt investments often come in the form of loans and bonds, giving institutional investors a wide range of options.

Hedge funds

Hedge funds are a popular form of alternative investment among institutional investors. Hedge funds typically involve the pooling of institutional money to invest in various strategies, such as long/short equity, volatility arbitrage and distressed debt. The aim is to produce returns that are not correlated with traditional asset classes, and often lead to higher returns than the broader public markets.

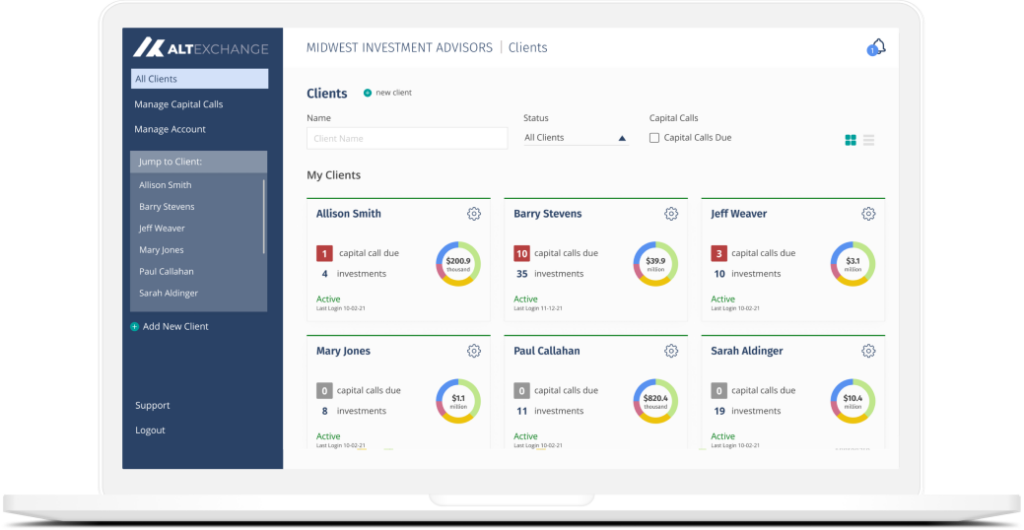

How to manage your alternative investments

As allocation to alternative investments continue to grow, it’s imperative for advisors to have a streamlined, scalable solution to manage the complexities.

AltExchange eliminates common pain points of managing complex alternative investments including fragmentation, unstructured data, scattered documents, limited performance visibility, and more. If you’re an advisor, investor, or asset manager looking for a full-solution management and reporting solution for alternative investments, please get in touch.