According to a recent Cogent Syndicated report, one in three (33%) financial advisors predicts economic conditions will worsen over the next three months. As a result, financial advisors are expressing increased interest in alternative investments as a way to hedge against inflation and combat other economic concerns.

Here are the top three investment categories advisors are paying the most attention to right now (according to the same report):

- Real assets/commodities (29%)

- Real estate/REITs (26%)

- Other alternatives (22%)

Let’s take a deeper dive into each of these categories, the role they play in your clients’ portfolios, and why they may be of interest right now.

Real assets/commodities

Real assets refer to a physical asset that holds value. Commodities refer to basic goods, typically raw materials, such as oil, gas, metals, corn, soybeans, and gold.

Pros of commodities: Commodities’ value are not highly-correlated with public markets or with any other financial assets, therefore serving as a strong hedge against inflation and other economic uncertainties. In fact, the value of most commodities increases alongside inflation.

Overall, commodities can serve portfolios in managing volatility, providing diversification, and offer potential upside during economic downturns.

Cons of commodities: One consideration, however, is that commodities are usually cyclical and their value can be dependent on external factors such as weather, politics, and production.

According to Michelle Cluver, portfolio strategist at Global X, “Commodity markets are currently balancing between the war in Ukraine, creating uncertainty about supply, and Chinese lockdowns raising concerns about lower economic growth.”

Real estate/REITs

Real estate as an investment involves the purchase, management, development, or sale of real estate to generate profit (rather than serving as a primary residence). Real estate investments include physical properties such as single and multi-family homes, commercial buildings, land, infrastructure, and more.

REITs are real estate investment trusts that a company owns in order to generate income-producing profits. REITs can cover the ownership of any type of real estate, like the ones listed above, and even the financing of real estate.

Pros of real estate/REITs: Real estate can provide a physical store of value, potential for passive income, equity, tax advantages, leverage, and more. Real estate is also less volatile than public market investments and is a great way to diversify your portfolio.

REITs offer the benefits of traditional real estate investing without the high level of maintenance typically required. Investing in REITs is also a much simpler process than investing in physical property. Investors can buy and sell REITs through their traditional brokerage account, just as you can stocks.

Cons of real estate: While there are plenty of advantages, real estate can be a tricky investment and requires extensive research and effort to bring in positive returns. For starters, real estate is illiquid, meaning it cannot be easily bought and sold like stock market investments. Second, real estate often requires long periods of time in order to become profitable. Thus, requiring lots of patience on the investors’ end. And finally, for those who are considering real estate right now, mortgage rates are soaring making it an unaffordable option for some buyers.

What about REITs? A few drawbacks of REITs include sensitivity to rising interest rates which can lower share price, property taxes, and high tax rates.

Other alternative investments

“Other” alternative investments is a broad category, so here’s a breakdown of some of the most common alternative investments in addition to commodities and real estate, and the pros and cons of alternative investments in general:

- Private equity

- Venture capital

- Hedge funds

- Startups

- Private credit

- Collectibles

Pros of alternative investments: The largest advantage of alternative investments (specifically illiquid alternative investments), is that they are non-correlated to the stock market. In today’s economic conditions with continued volatility, increasing inflation, and effects of the COVID-19 pandemic and ongoing war, this is a crucial benefit that financial advisors and investors must take into consideration.

Cons of alternative investments: Unfortunately, alternative investments can be more complex than their traditional counterparts. Access was historically limited to institutional investors, and while it’s starting to improve, it’s still very limited. While the investment process itself is more complex, historically speaking, so is the reporting aspect. According to a CAIS survey, 37.6% of financial advisors report high levels of administration and paperwork as barriers in offering alts to clients. But new technology is helping break those barriers.

How financial advisors can streamline alternative investment workflow

Believe it or not, most financial advisors who offer alternative investments are still tracking data manually via spreadsheets, inputting numbers from scattered PDF documents, in an unsustainable reporting process for clients.

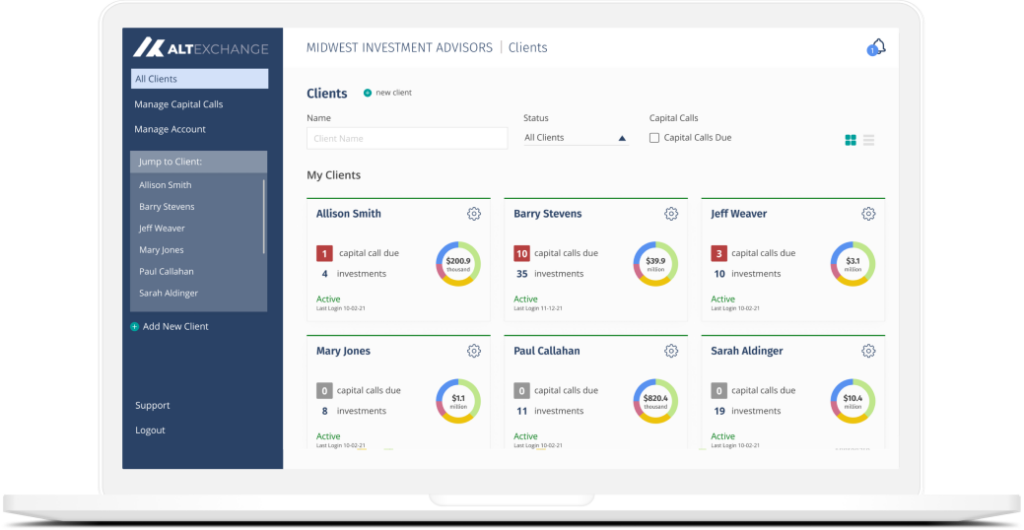

AltExchange automates alternative investment workflow for financial advisors through our technology-powered platform, AdvisorVue. With AdvisorVue, advisors can easily offer alternative investments and automate the tracking, reporting, and management process in one simple solution. AdvisorVue allows advisors to provide family office-like services, without the added costs of staffing.

If you’re an advisor interested in streamlining your alts workflow, please book a call or schedule a demo.