Access farmland investing without another platform to manage.

Alternative farmland investments for your clients. Transparency for you.

Visibility Into Your Clients’ AcreTrader Investments

AltExchange powers AcreTrader investment reporting data for wealth advisors and clients with:

- A single hub to see clients’ AcreTrader investments, notifications, reports, and tax documents.

- Seamless integration with your existing wealth management systems for a comprehensive look at clients’ AcreTrader (and other alternative) investments.

- A secure digital portal for viewing documents.

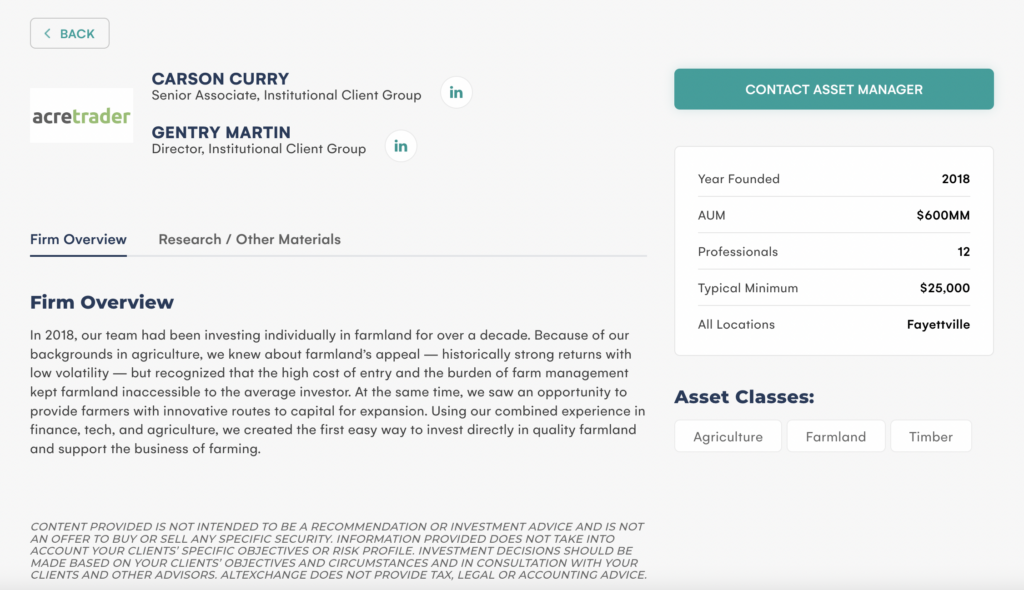

Learn More About AcreTrader

AcreTrader is the farmland investing platform that provides access to farm and timberland assets online. AcreTrader makes the historically consistent performance of farmland available to qualified investors through private placements at more accessible minimums, without the burden of asset class management.

Learn More About AltExchange

AltExchange is the simple technology-powered solution that allows financial advisors and investors to easily manage alternative investments. Through seamless integrations with leading wealth management platforms, advisors can now gain a holistic view of their clients’ portfolios.

Securities are offered through AcreTrader Financial, LLC, a broker dealer registered with FINRA and a member of SIPC. Information on all FINRA registered broker dealers can be found on FINRA’s BrokerCheck. AcreTrader Financial is not yet registered as a broker-dealer in FL.

Alternative investments are considered speculative, involve a high degree of risk, including complete loss of principal and are not suitable for all investors. Learn more about the risks of investing in farmland and the nature of the asset class by looking at our general risk factors. Past performance does not guarantee future results. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with your financial or tax professional. Private investments are unregistered securities and subject to certain limitations and restrictions.

There is no assurance any fund will meet its objectives. Investments are illiquid, not listed on an exchange, and not a short-term investment. Distributions are not guaranteed. Offering represents interest in a newly formed entity. Changes in tax law may adversely affect offerings.